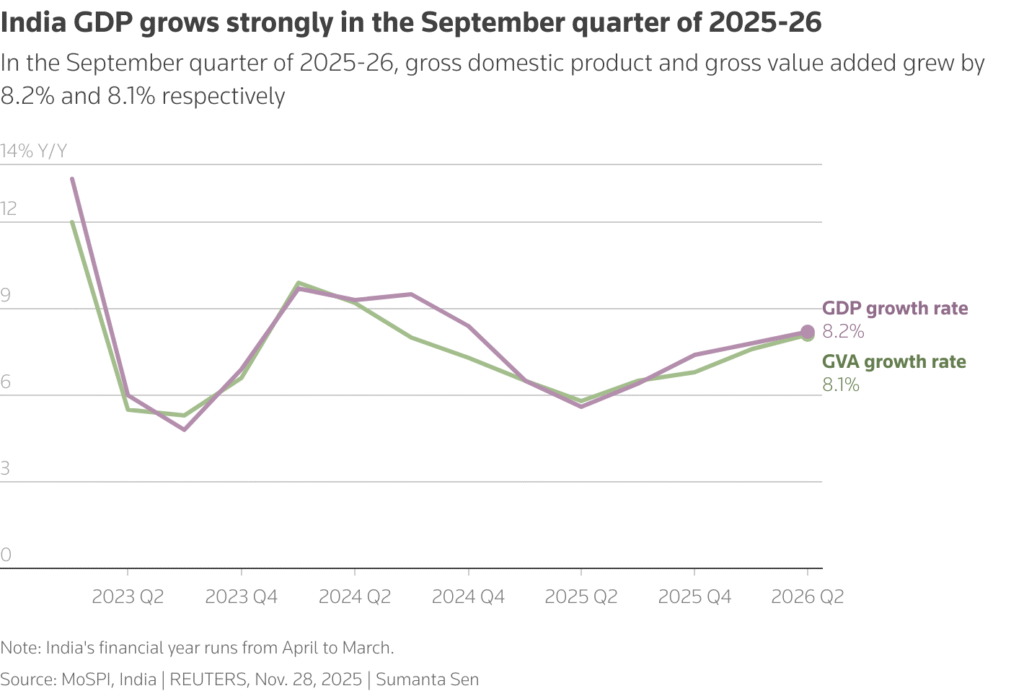

India’s economy grew 8.2% year-on-year between July and September, outpacing expectations and registering its fastest expansion of the financial year despite the United States imposing steep punitive tariffs on Indian exports.

Economists polled by Reuters had projected 7.3% growth for the quarter. The strong performance came even as Washington raised its tariff on certain Indian goods by an additional 25%, taking the total levy to 50%, in response to New Delhi’s continued purchase of discounted Russian oil.

India’s GDP had risen 7.8% in the previous April–June quarter.

Consumer Spending Leads the Charge

Private consumption accounting for 57% of GDP expanded 7.9% in July–September, up from 7% in the previous quarter. The acceleration was supported by:

-

Strong festival-linked demand

-

Pre-holiday stockpiling by retailers

-

Front-loaded exports ahead of the August 27 tariff deadline

Economist Garima Kapoor of Elara Securities noted:

“The blockbuster GDP growth has been led by front-loading of exports. Full-year FY26 GDP growth is now expected to be close to 7.5%, well above government and RBI estimates.”

Government Measures Cushion US Tariff Shock

To counter subdued global demand and soften the blow of US tariffs, India rolled out tax cuts on mass-consumption goods in late September. The move, combined with earlier monetary easing, helped support domestic demand.

Sector-Wise Growth Snapshot

-

Manufacturing: up 9.1%, compared with 7.7% last quarter

-

Construction: up 7.2%, compared with 7.6% earlier

-

Agriculture: up 3.5%, slightly lower than 3.7% the previous quarter

-

Government spending: fell 2.7%, after rising 7.4% in April–June

Gross Value Added (GVA) seen as a better indicator of economic activity rose 8.1%, compared with 7.6% in the previous quarter.

Nominal GDP growth stood at 8.7%, marginally lower than last quarter’s 8.8%, which could weigh on companies’ profits and tax revenues.

Retail Inflation Hits Record Low

Retail inflation in October plunged to a historic 0.25%, sharply increasing the likelihood of an RBI rate cut at the December monetary policy meeting. The central bank has already delivered 100 basis points of rate reductions this year.

RBI Governor Sanjay Malhotra said this week that further rate cuts are possible as inflation stabilises.

Strong Growth Outlook Despite Trade Uncertainties

The government expects resilient domestic demand, steady public investment, and cooling inflation to sustain momentum through FY26 even amid external trade pressures.

The RBI currently projects 6.8% GDP growth for the full year ending March 2026, though today’s numbers suggest the final tally could be significantly higher.