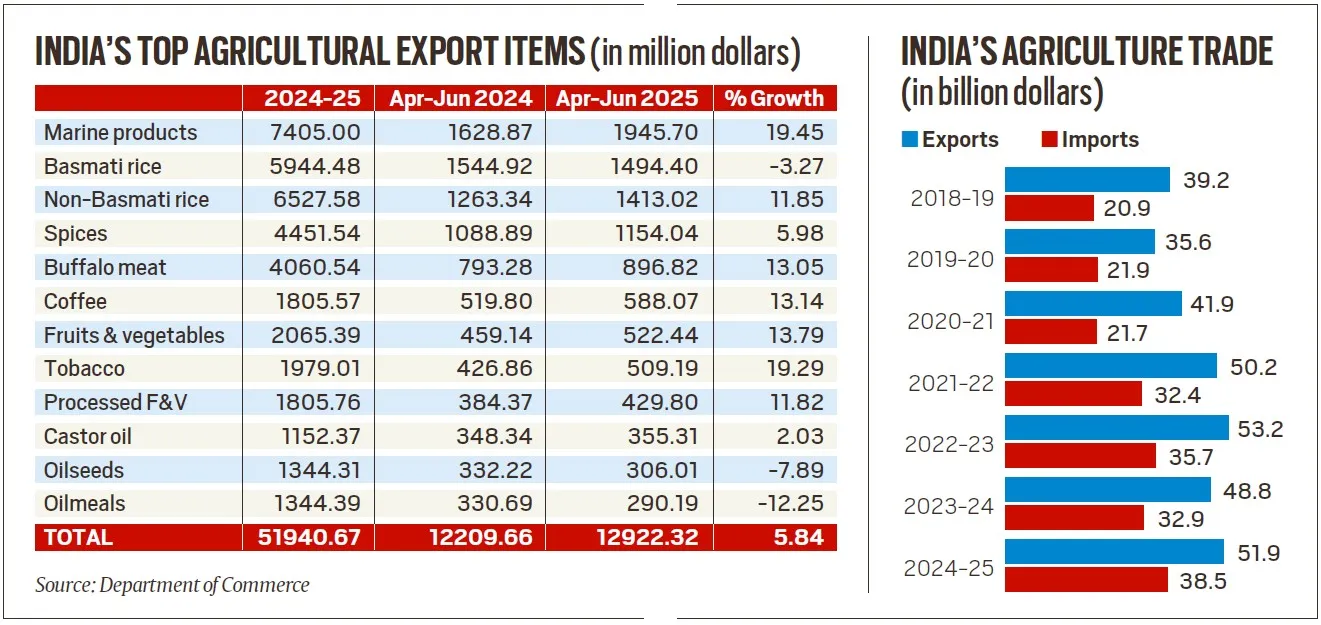

India’s agricultural sector remains a bright spot in the country’s trade story. Even as overall merchandise exports barely moved in 2024-25, farm produce shipments grew 6.4% to touch $51.9 billion, up from $48.8 billion the previous year. Imports, however, have also risen — leaving a smaller surplus than a decade ago.

Union Commerce Minister Piyush Goyal says he is confident that exports will climb higher this fiscal, despite possible hurdles from global trade tensions. The optimism comes even with US President Donald Trump’s decision to impose a 50% duty on Indian goods starting August 27 — a move that could hit key items like marine products.

Farm Exports Buck the Flat Trend

While total merchandise exports for 2024-25 stood at $437.4 billion — only 0.1% higher than the previous year — agriculture outperformed. The first quarter of 2025-26 (April–June) saw farm exports grow by 5.8% year-on-year, driven by strong demand for marine products, non-basmati rice, buffalo meat, coffee, tobacco, and fresh & processed fruits and vegetables.

One big factor: favourable weather. After a drought year in 2023-24 that forced the government to ban or restrict exports of wheat, rice, sugar, and onion to control food inflation, good monsoons have brought those restrictions down.

India’s coffee and tobacco exporters also got a boost from poor harvests in other producing countries like Brazil, Vietnam, and Zimbabwe, which pushed up prices and demand for Indian supply.

📊 The export story is equally telling when we look at the top-performing farm products and how agricultural trade has evolved over the past six years.

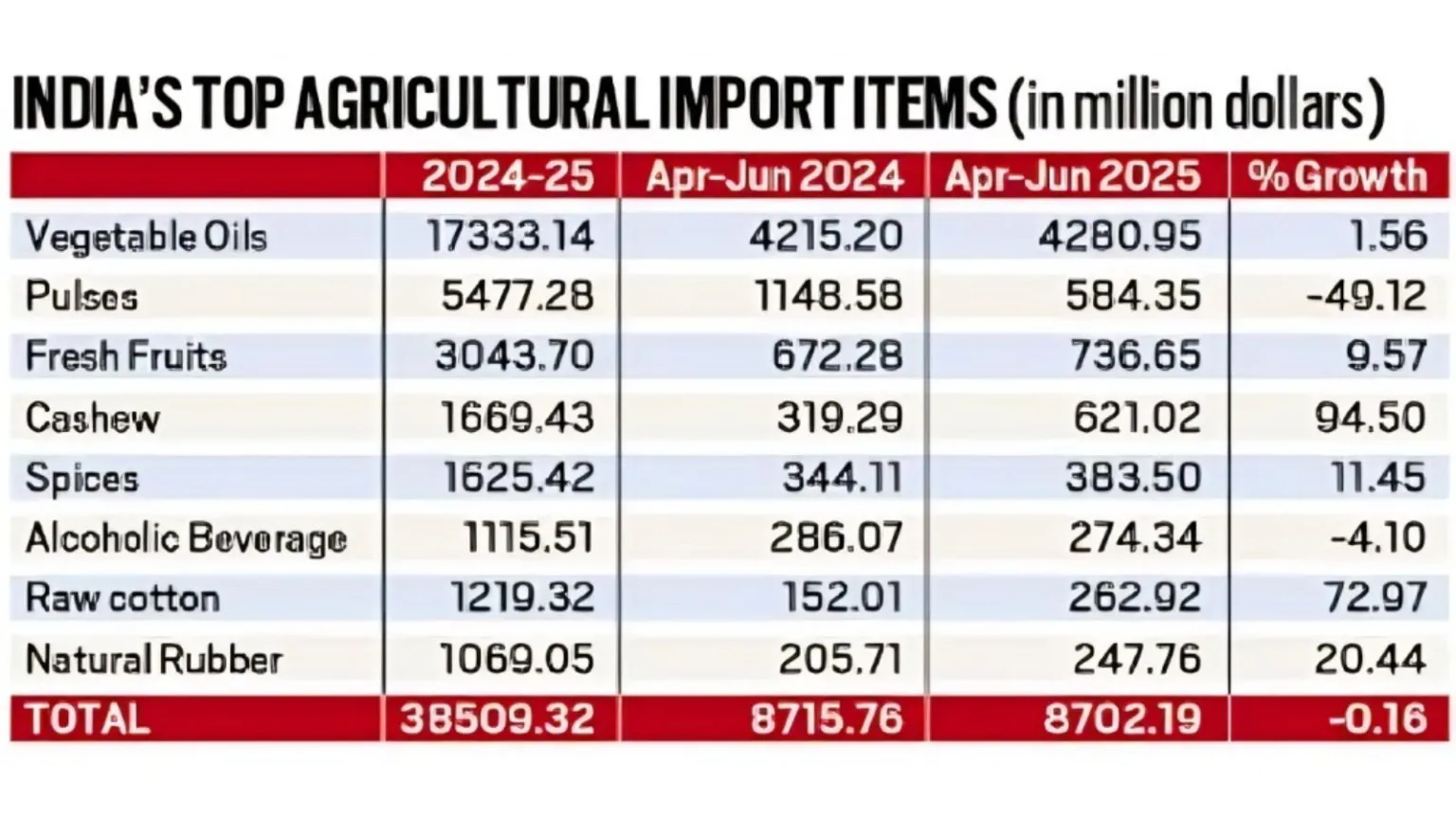

What We’re Importing

India still exports more farm goods than it imports — but the gap is narrowing. In 2024-25, agricultural imports stood at $38.5 billion, leaving a surplus of $13.4 billion. That’s less than half the $27.7 billion surplus recorded in 2013-14.

The reason? Imports have grown faster than exports. More than two-thirds of India’s farm import bill comes from just three categories: vegetable oils, pulses, and fresh fruits.

Vegetable oil imports — mainly palm, soyabean, and sunflower — have continued to rise, with domestic production unable to meet demand. Pulse imports hit a record 7.3 million tonnes in 2024-25 due to the drought’s impact on production, though better crops this year have eased the pressure.

📊 Government data shows the breakdown of India’s major farm imports in 2024-25, with vegetable oils alone making up nearly half of the bill.

If current trends hold, India’s farm exports could reach $55 billion in 2025-26, surpassing the previous record of $53.2 billion in 2022-23. But risks remain. The US market accounts for a third of India’s marine product exports — especially shrimps and prawns — and higher tariffs there could dampen earnings.

Still, with two consecutive good monsoons, rising global demand for certain commodities, and the gradual lifting of export bans, the farm sector remains one of India’s strongest trade stories