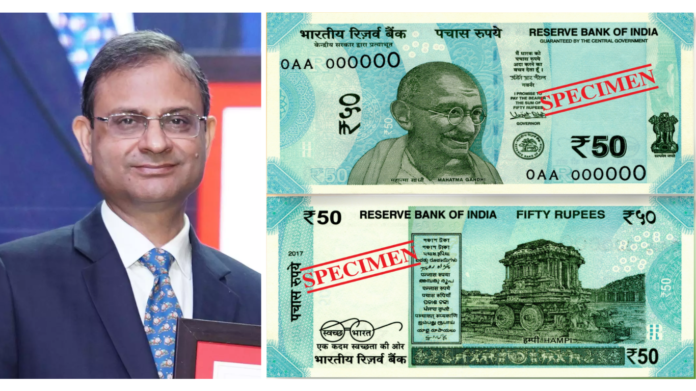

A brand-new ₹50 note is set to enter your wallets soon, and while it may look the same as before, there’s a fresh twist – it will now carry the signature of Sanjay Malhotra, the newly appointed Governor of the Reserve Bank of India (RBI).

The RBI has confirmed that these new ₹50 notes will be part of the Mahatma Gandhi (New) Series, maintaining the same bright blue design that people are familiar with. But what makes this release interesting? Let’s break it down.

What’s New in the ₹50 Note?

Sanjay Malhotra’s Signature – The Stamp of Change

Every time a new RBI Governor takes charge, there’s one thing that signals their arrival in a very real, tangible way – their signature on banknotes. And now, it’s Sanjay Malhotra’s turn to leave his mark on Indian currency. For currency collectors and finance enthusiasts, getting hold of the first batch of notes featuring a new governor’s signature is always an exciting moment. It symbolizes a new era in India’s monetary policy and serves as a small, but significant, piece of history in your hands.

Hampi’s Chariot Still Stands Tall

Flip over the ₹50 note, and you’ll still see the iconic stone chariot from Hampi, a UNESCO World Heritage Site that showcases India’s rich cultural history.This intricate structure from the Vijayanagara Empire isn’t just a design choice – it reflects the country’s blend of history, art, and tradition on something as everyday as a currency note. Imagine carrying centuries of history right in your pocket!

No Panic – Old ₹50 Notes Stay Valid

If you were worried about your old ₹50 notes suddenly becoming useless, relax! The RBI has confirmed that all previously issued ₹50 notes will remain legal tender. So, while you might soon start seeing Malhotra’s signature on new notes, your older ₹50 notes signed by previous RBI Governor Shaktikanta Das will still be accepted everywhere. No demonetization, no stress – just an upgrade in signature.

Beyond Currency – RBI’s Big Move on Repo Rate

While a new ₹50 note is exciting for collectors and cash lovers, Sanjay Malhotra didn’t just stop there. His first big move as RBI Governor was to slash the repo rate by 25 basis points, bringing it down from 6.5% to 6.25%.

Now, if you’re wondering what that means for you beyond finance news, here’s the deal:

Loans Might Get Cheaper

If you’re planning to take a home loan, car loan, or personal loan, banks might lower their interest rates, making borrowing cheaper. Businesses looking for loans could benefit too, encouraging more investment in different industries.

More Money in Your Pocket?

Lower loan interest rates mean EMIs could reduce, leaving you with extra cash to spend. If banks pass on the benefits, even credit card EMIs and overdraft rates could go down.

Will Fixed Deposits Take a Hit?

On the flip side, if banks reduce interest rates on savings accounts and fixed deposits, your savings returns might shrink. This move could push investors to explore stocks, mutual funds, or gold instead of keeping all their money in fixed deposits.

Why Is RBI Doing This?

After 12 straight policy meetings where the repo rate remained unchanged, Malhotra has decided to ease borrowing costs – a signal that the RBI wants to boost economic growth. This could be a strategy to push spending, increase demand, and ensure India’s economy remains strong in the coming months. But the real question is – will banks actually pass on these benefits to the people?

A New ₹50 Note and a New Direction

The announcement of the new ₹50 note with Sanjay Malhotra’s signature might seem like a small update, but it represents a changing chapter in India’s economic policies. From history on the note (Hampi’s chariot) to history in the making (RBI’s repo rate cut), these moves indicate that the Malhotra era at RBI could bring major economic shifts in the coming months. So, whether you’re a currency collector, an investor, a borrower, or just someone who loves fresh, crisp notes, this news touches everyone in different ways. Keep an eye out for those new ₹50 notes, and let’s see how Malhotra’s RBI shapes India’s financial future!