U.S. President Donald Trump has once again turned to tariffs as his preferred policy lever—this time, targeting the global pharmaceutical supply chain. In a recent interview with CNBC, Trump announced that he may impose import tariffs on pharmaceuticals as high as 250%, a dramatic escalation from earlier proposals.

“We want pharmaceuticals made in our country,” Trump said, citing national security concerns and declining domestic manufacturing as reasons behind the aggressive move.

The president said he would start with a “small tariff,” increase it to 150%, and then possibly to 250% over the next 12 to 18 months. This comes on the heels of a Section 232 investigation launched in April 2025, which allows the U.S. government to impose trade restrictions on imports deemed a threat to national security.

India’s $50 Billion Pharma Industry Faces a Serious Threat

If implemented, these tariffs could severely undercut India’s pharmaceutical exports to the United States, a sector that forms the backbone of its $50 billion generics industry. Indian drugmakers currently enjoy a significant price advantage in the U.S. market—especially in cost-sensitive areas like Medicaid, Medicare, and generic drug procurement for low-income populations.

Tariffs of this magnitude would cripple that edge, forcing companies to either absorb losses or pass costs onto patients—both of which would have far-reaching implications for access and affordability in the U.S.

Trump’s Pharma Gamble: Populism Meets Protectionism

Trump’s push is part of a broader effort to bring back pharmaceutical manufacturing to American soil. Industry giants like Eli Lilly and Johnson & Johnson have already announced new domestic investments, signaling their intention to align with the administration’s direction.

But critics argue that such protectionist measures could disrupt global supply chains, raise drug prices, and reduce the availability of life-saving medications.

Trade experts have also questioned whether a national security rationale—the foundation for invoking Section 232—can truly be justified in the context of generic medicine imports. Many of these drugs are not manufactured at scale in the U.S., and a sudden reshoring of production could lead to critical shortages.

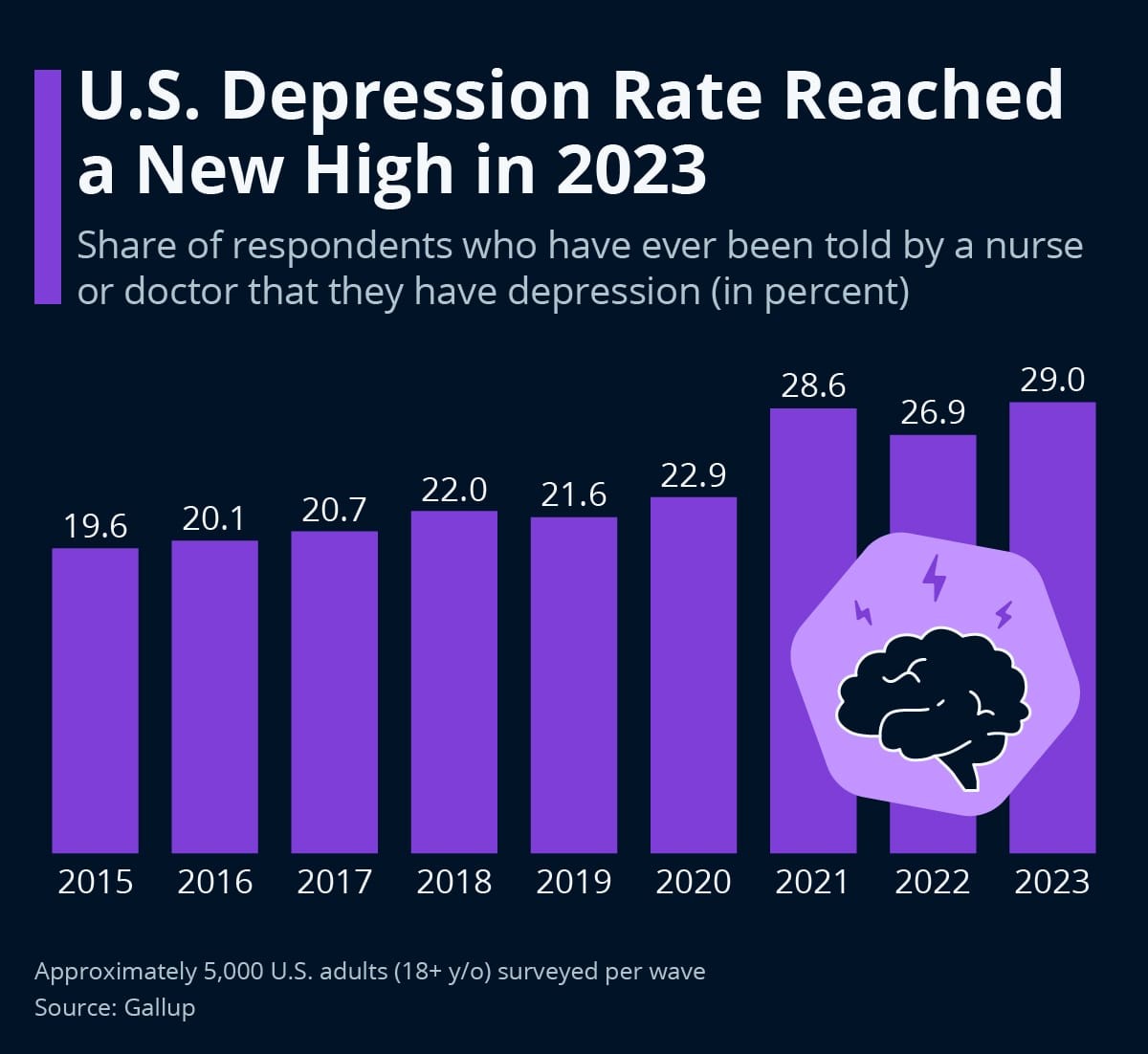

📊 The Mental Health Dimension: Tariff Risk Amid Rising Depression

According to Gallup, the U.S. depression rate reached an all-time high of 29% in 2023, underscoring a growing public health crisis. The demand for mental health medications, including antidepressants and anti-anxiety drugs, is rising rapidly.

-

India is a major supplier of these generics to the U.S.

-

A 250% tariff could make these drugs more expensive, reducing access for low-income and Medicaid-dependent patients.

-

This may worsen the treatment gap in a country already grappling with underfunded mental health systems.

In this light, Trump’s tariff plan is more than an economic decision—it may have serious human consequences, especially for Americans already vulnerable to mental health challenges.

The Bigger Picture: India, the U.S., and the Future of Global Health Supply Chains

For India, this proposal poses both an economic and diplomatic challenge. The U.S. remains its largest pharmaceutical export destination, and any shift in policy has the potential to reverberate across the Indian economy, employment, and healthcare access globally.

More broadly, the move reflects a trend of re-shoring and economic nationalism gaining ground in the West—a sharp departure from the globalised supply chain model that has driven down drug prices and expanded access worldwide.

If these tariffs move forward, they won’t just hurt Indian companies. They’ll mark a step away from global cooperation in public health, toward a more insular, politically driven model—where access and efficiency may come second to manufacturing location.