US President Donald Trump’s decision to impose sanctions on two of Russia’s largest oil producers Rosneft and Lukoil is set to hit India’s refining sector, particularly Reliance Industries Ltd (RIL) and Nayara Energy, which rely heavily on discounted Russian crude.

According to industry experts, these sanctions could reduce Reliance’s EBITDA by ₹3,000–3,500 crore, as Indian refiners brace for a sharp drop in Russian oil supplies and rising costs from alternative sources.

Why the sanctions matter for India

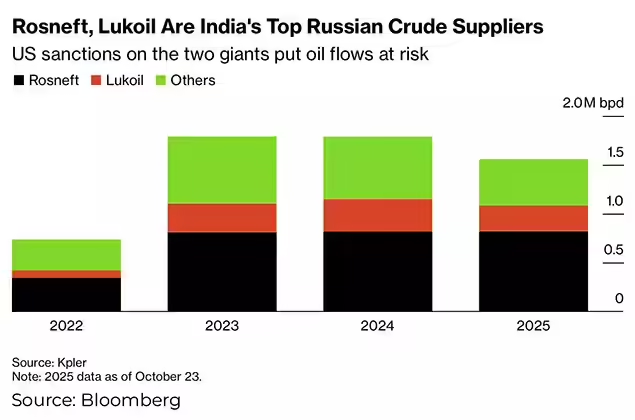

Before the Russia-Ukraine war, India sourced most of its crude oil from the Middle East. But as the conflict escalated in early 2022 and G7 nations imposed a $60-per-barrel price cap on Russian oil, India turned to Moscow’s discounted barrels to meet demand.

Since then, Russian oil has made up nearly 25% of India’s total crude imports, helping refiners like RIL and Nayara maintain strong margins despite global volatility. With the latest sanctions in place, this supply cushion may now shrink significantly.

How Reliance and Nayara are affected

Analysts say that RIL’s oil-to-chemicals (O2C) segment which contributes nearly one-third of its total earnings could see an estimated 12% increase in refining costs as the company scrambles to source non-Russian crude.

“RIL, which had signed a crude supply agreement with Rosneft, will not be able to honour its terms given the new sanctions,” an industry analyst said, adding that even a $1 increase in gross refining margin can swing earnings by 2%.

At present, Reliance’s O2C EBITDA stands at ₹15,008 crore, with its total group EBITDA at ₹50,367 crore. Even if impacted, experts believe the company’s diversified portfolio will help it absorb part of the hit.